Most deals do not die suddenly. Financing gets fragile long before the appraiser hits “send.”

At the recent CE Continuing Ed Presentations, hosted by our friends at Carter Law Office, PC, Adam from Aladdin Appraisal spent the morning with a packed room of agents talking about one thing:

How to spot appraisal risk early so your clients feel safer and more deals actually close.

This was not a sales pitch. The goal was simple:

If even one overwhelmed agent walked out thinking, “Okay, I know what to watch for now,” the job was done.

How this talk came together

This session started with a relationship, not a cold email.

Adam and loan originator John Marroni of Cornerstone First Mortgage work together in a network of divorce professionals here on the North Shore of Boston. Through that connection, John shared Adam’s work with Attorney Rick Carter, who invited Adam to join the CE speaker lineup.

We are grateful to both John Marroni and Rick Carter for the trust, the introduction, and the chance to serve their agent community.

Why appraisal problems are rarely a surprise

From the outside, appraisal issues can feel like they come out of nowhere. One day the deal looks fine. The next day you get the call that value came in low or the loan is on hold.

In reality, most appraisal “disasters” start much earlier, with things like:

Missing or wrong square footage

Unclear condition or undocumented updates

Safety issues that are obvious the moment you walk up to the house

Gaps in the file that make underwriters ask more questions

Underwriters do not like mystery. When the story of the property is not clear, that is when loans slow down or stop.

The 3 early moves smart agents make

Adam shared three practical moves agents can make before the appraiser ever shows up at the property.

Move 1: Know what you are actually selling

Professionals do not guess at fundamentals. Square footage and safety are fundamentals.

Do not rely only on public records or quick auto floor plans. They are often wrong.

ANSI measurement rules matter, especially for capes, bungalows, and homes with finished basements.

If there is a 30 inch drop without a guardrail or obvious safety issues, expect “subject to” repairs that can slow things down.

Smart move:

Get reliable measurements and walk the property with a simple safety checklist so you are not surprised later.

Move 2: Talk to the appraiser the right way

For years, many agents were told, “Never talk to the appraiser.”

In reality, good appraisers want solid information. What they cannot accept is pressure.

Move 2 is about shifting from “Can you hit this number?” to “Here is the clearest picture of this property.”

What not to say

There are a few phrases that make appraisers and lenders tighten up right away:

“We need this number to make the deal work.”

“If it does not come in at the contract price, the whole thing falls apart.”

“Can you just make sure we are at XXX so everyone is happy?”

Those lines sound like you are asking the appraiser to protect a specific outcome, not give an independent opinion. That puts their license and the loan at risk, so they have to pull back.

Become the “chief information officer” for the property

Instead, think of your role as chief information officer for this one house or condo.

Your job is to make sure the appraiser has the same clear story you have been telling the buyer and seller.

Here is what actually helps:

A clean data packet

MLS sheet plus public record printout

Floor plan with measurements

A short list of meaningful updates with dates (roof, systems, kitchen, bath, major exterior work)

3–5 true substitute sales

Recent, genuinely comparable homes your buyer would have considered as Plan B

One sentence on each: why it is similar, and why your subject competes with it

Language that works: “These are a few sales we used when we priced the home. If they look appropriate, we would love for you to consider them.”

Quick market context

What you are seeing in this micro-market: list-to-sale patterns, days on market, any clear shift in the last 60–90 days

Keep it factual, not emotional. You are giving color, not arguing value.

Hidden details that do not show up in photos

Deeded parking, rights-of-way, or easements that help the property

Permitted in-law, legal finished space, or system upgrades that matter for long-term livability

This kind of input keeps you firmly in the lane of sharing facts, which appraisers and underwriters are allowed to use.

One big guardrail

Once the report is in, remember that the appraiser’s client is the lender, not the agent or the buyer.

Any follow-up on value has to go through the lender, not directly back to the appraiser. At that point, the appraiser cannot discuss the file with you one-on-one.

Takeaway:

Do not tell the appraiser the number you need.

Give them the facts they need to do solid work.

Move 3: Know when and how to challenge the appraisal

When value comes in low, you have more options than “rant and reload.”

There is a structured process called a reconsideration of value. For most loans, the borrower gets one formal shot at this, and lenders typically allow up to five closed sales to be presented as potential alternatives. That is why preparation matters.

Here is a simple way to approach it:

Check for clear factual errors

Bed and bath count

Square footage and finished areas

Missed significant updates or features

Gather up to five truly comparable closed sales

Similar location, size, condition, and appeal

Realistic “Plan B” options for your buyer

Write short, fact based notes on why your comps are stronger

One or two sentences per sale is enough

What to avoid:

Pressure, accusations, or personal attacks on the appraiser

Huge lists of marginal sales that do not really match the subject

You send this package to the lender, who then decides whether to ask the appraiser to review it. The communication stays between the lender and the appraiser because of appraiser-client rules.

Smart move:

Use your one reconsideration shot wisely. Lead with clear facts and strong comps, not emotion.

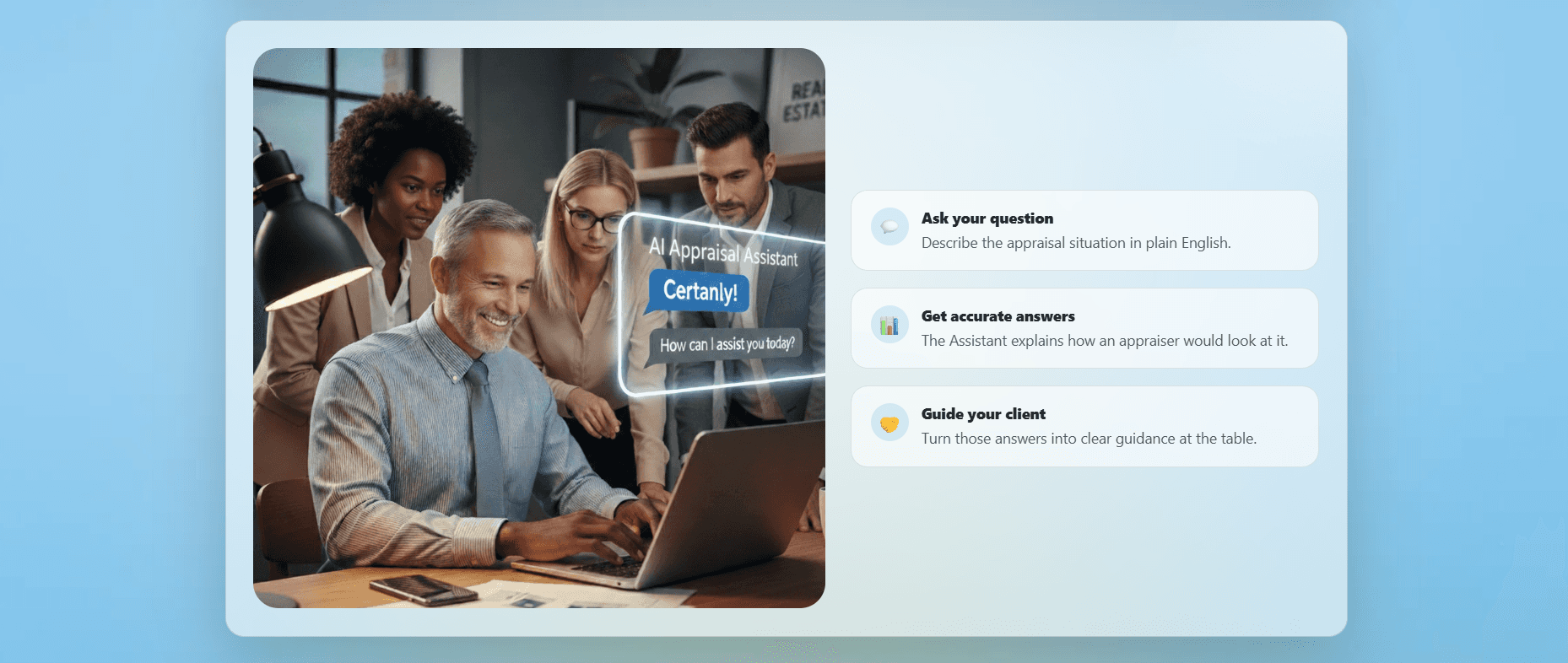

A new tool in your pocket: The Appraisal Assistant for Real Estate Agents

The last part of the session introduced something new.

Most agents do not have hours to read guidelines or memorize FHA repair rules. So we built the Appraisal Assistant for Real Estate Agents to act like an on-call appraisal guide.

You can open it any time here:

👉 https://appraisal-assistant.aladdinappraisal.com/home

Agents are already using it to ask questions like:

“Is this property likely to qualify for a no appraisal option?”

“Which repairs are most likely to be required here?”

“What parts of this finished basement will actually count in square footage under ANSI?”

“What should I double check before asking for a reconsideration of value?”

Any time you wish you could call an appraiser during a listing, that is your cue to open the Appraisal Assistant and ask.

If you were in the room, you saw the QR code and live demo. If you could not make it and would like access, visit the link above or send us a quick note and we will get you set up.

Thank you to everyone who joined

Thank you again to John Marroni of Cornerstone First Mortgage for the introduction and to Attorney Rick Carter and the team at Carter Law Office, PC for hosting such a thoughtful CE day. And thank you to every agent who shared real world questions and stories.

When you:

Know what you are actually selling

Talk to the appraiser the right way

Know when and how to respond if value comes in low

you get fewer surprises, calmer clients, and more deals that actually close.

If you would like help with a pre-listing appraisal, measurement, or a second set of eyes on a tricky situation, we are happy to be a resource.

Call us today at (617) 517-3711 to get a free quote

or email info@aladdinappraisal.com.